Posted on: March 25, 2024, 12:21h.

Last updated on: March 25, 2024, 12:26h.

The stock symbol that former President Donald Trump’s casino business traded under in the late 1990s is expected to soon return to Wall Street.

Trump won a major victory Monday morning when a New York appeals court agreed to halt collection of the presumptive Republican presidential nominee’s assets if he puts up $175 million in collateral within 10 days. The bond or securities requirement comes after Trump was ordered to pay $454 million related to a civil fraud judgment. Trump is appealing the ruling.

Trump is planning to raise cash for his legal costs by taking his social media platform, Truth Social, public. The billionaire hopes to merge his Trump Media & Technology Group with Digital World Acquisition Corp. (DWAC), a Miami-based special-purpose acquisition company (SPAC) with ties to Trump.

DWAC shareholders approved merging with Trump Media & Technology on Friday. In exchange for acquiring Truth Social, Trump would receive nearly 80 million DWAC shares. With the stock trading around $44 in early afternoon trading on Monday, Trump’s position would be worth more than $3.5 billion.

Casino Ticker

Trump made most of his fortune by building, owning, and selling prime real estate in Manhattan. But his ventures in the Atlantic City and Indiana casino industries also played a role.

In 1995, he established Trump Hotels and Casino Resorts (THCR) and took the business public on the New York Stock Exchange under the stock symbol “DJT.” Trump’s middle name is John.

The company became Trump Entertainment Resorts in 2004 after THCR went bankrupt. Trump Entertainment Resorts traded under the ticker “TRMP.”

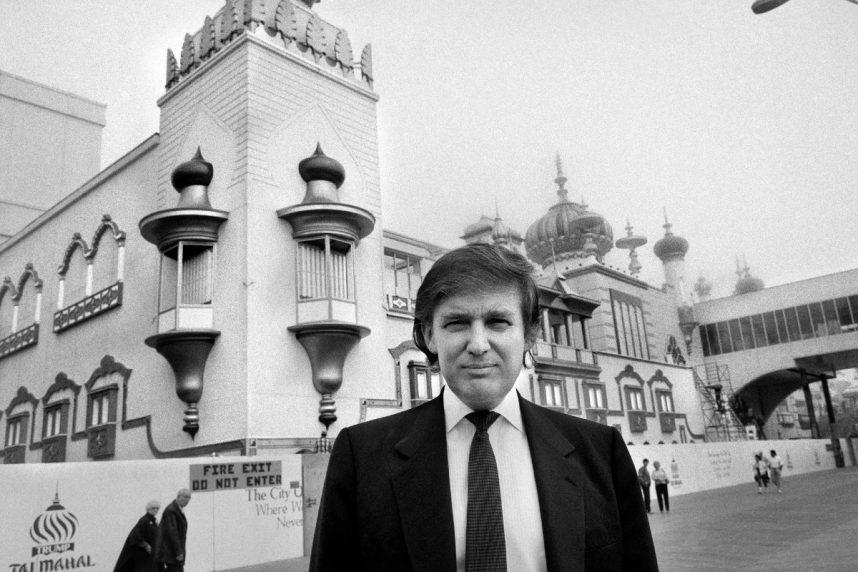

The billionaire’s casino developments included Atlantic City’s Trump Plaza (demolished), Trump World’s Fair (demolished), Trump Castle (today Golden Nugget), and Trump Taj Mahal (today Hard Rock). Trump also ran the Trump Casino riverboat in Gary, Ind.

If DWAC’s acquisition of Truth Social is completed, the blank-check company will be listed on the Nasdaq stock exchange with the resurrected “DJT” symbol.

Trump exited the gaming industry long before his name was taken down in Atlantic City. Trump’s casino business incurred three bankruptcies in 2004, 2009, and 2014.

Fellow billionaire Carl Icahn acquired Trump Entertainment Resorts in early 2016 for an undisclosed sum and continued to use the Trump brand until he shuttered the company’s lone remaining property, Trump Taj Mahal, in October 2016.

Icahn blamed the local casino union for the Boardwalk resort’s fiscal struggles. He sold the desolate resort to Hard Rock International in 2017 for just $50 million. Hard Rock, controlled by the Seminole Tribe of Florida, pumped more than $500 million into the resort and reopened it in June 2018.

Trump Beneficiary

Trump’s publicly traded entities made the casino tycoon vastly wealthy. That wasn’t the case for many investors.

When THCR went public in 1995, the stock debuted at $14 each, and over 10 million shares were sold. The stock had climbed to $35 a year later. Trump cashed many of his shares and received a handsome salary and bonuses during the run.

CNBC reported that THCR lost $66 million despite its stock reaching an all-time high in 1997. The company lost $134 million in 2004 and filed for Chapter 11 bankruptcy protection and was delisted from the New York Stock Exchange.