putilich

Thesis

SaaS (Software as a Service) companies are unique and cannot be analyzed in a traditional manner, such as looking at GAAP Price/Earnings ratios or Price/Book. This article seeks to find “best-in-class” SaaS companies using specialized quantitative and qualitative metrics. After discussing the industry’s size & growth, I will screen and rank from a list of 84 companies. I note unique attributes of SaaS companies such as operating leverage, scalability and optionality. I will present the top companies as a starting point for readers who can continue to research should they choose to do so. Lastly, I discuss valuations and suggest a way of including SaaS companies into one’s portfolio.

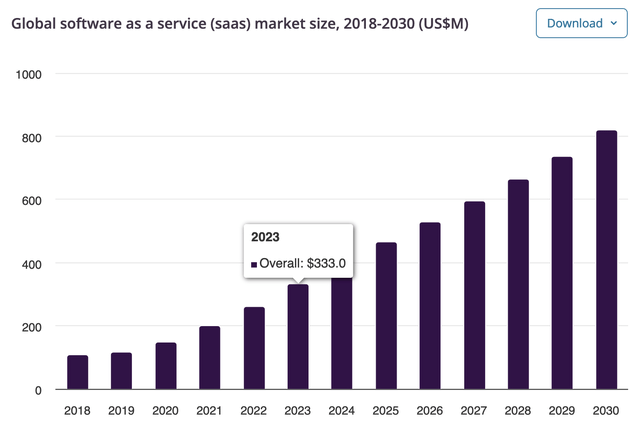

Industry Size and Growth

The broad SaaS industry including cloud infrastructure companies such as Google (GOOG) is huge at $333Bn in 2023 and growing 13.7% annually. Increased penetration of public cloud services (e.g., Amazon AWS) and CRM SaaS solutions have spurred growth, especially since Covid-19 (which increased demand for online education, e-commerce, online supply-chain management, office automation and electronic contracts.

Exponential Growth potential

Despite today’s focus on AI hardware companies such as Nvidia (NVDA) and Dell Technologies (DELL), I believe that software will continue eating the world as Marc Andreessen famously said. I believe that SaaS companies are the best positioned for this due to their:

- Network effect

- Scalability

- Strong FCF potential

- Optionality (such as integrating AI)

- Consistency (due to their subscription models)

From None to Many

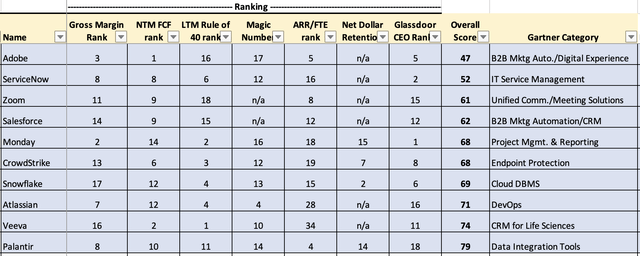

Way back in 2007 when I first dug into the SaaS “rabbit hole” there were few choices. Now thanks to the Fed’s money-printing, there are thousands of companies – not all will be successful. I screened for the “best” SaaS companies based on several KPIs (see below). The data is sourced from S&P Compustat (paywall) Meritech Capital and Glassdoor.

Key Operating Metrics

It’s easy to confuse operating metrics versus financial metrics. Operating Metrics tend to focus on marketing and customers. They measure things like customer behavior and efficiency. I included these:

- Magic Number: This metric measures how much revenue growth a company attains versus what was spent on marketing the previous quarter. (Best company: Atlassian (TEAM) – but note its high ranking is influenced by its “Self-Service” business model.)

- Payback Period: the time it takes for a company to recover its investment in acquiring a customer. This investment typically includes costs related to marketing, sales, and customer onboarding. (Best: Atlassian)

Key Financial Metrics

These metrics are more readily cited by SA contributors. They include:

- Gross Profit Margins: While most readers are familiar with gross profitability, I stress that a particular SaaS company’s GP margins may appear high when in fact they are significantly below average. For example, in a survey of 84 SaaS companies a 78% GPM would only be a middle of the road company as GPMs can breach 90% (Best: GitLab (GTLB): 91%).

- NTF FCF: This is the next twelve month expectations for Free Cash Flow. Note that it includes Stock Based Compensation as a non-cash positive adjustment to cash flow.

- Rule of 40: is typically the next FY’s revenue growth plus the next FY’s FCF margin. Rule of 40 is considered the most important attribute for successful SaaS companies. The tradeoff of Revenue growth and FCF margin change over time depending on a) whether the Fed is raising rates, b) stage in a company’s life cycle and c) management or investors’ focus. For example, older companies (Adobe (ADBE)) tend to have slower revenue growth but higher FCF margins. (Best rated. Veeva (VEEV).

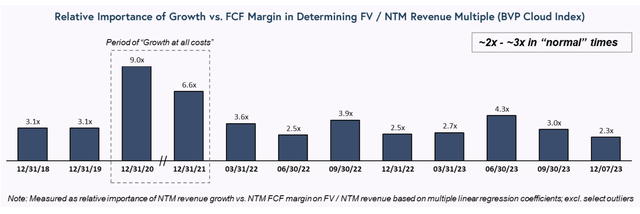

- Rule of X: is a modification of the Rule of 40 but it weighs (by 2x) revenue growth in the calculation. According to Bessemer Venture Partners SaaS companies with high Rule of X, trade at 2x-3x higher valuations compared to peers (Chart). (Best Rated: Monday.com (MNDY), CrowdStrike (CRWD) and Snowflake (SNOW)).

- ARR/FTE: Annual Recurring Revenue divided by the number of Full Time Employees. An ARR is pure subscription revenue so it excludes one-time payments and one-time discounts. While ARR is an important metric, I would caution readers from comparing them with other companies without first understanding their business models. For example, “self-service” business models such as Dropbox would have significantly lower ARR (given lower price-points) and lower CAC (customer acquisition costs). (Best rated: Palantir (PLTR)).

- Net Dollar Retention (NDR): measures recurring revenue from existing customers over a set period. It is affected by churn but doesn’t include new customers. I consider NDR the second-most important metric, hence I’ve written about Snowflake and CrowdStrike – both have high NDR. Unfortunately, not all companies report NDR and some use different calculation methods.

Key Qualitative Metrics:

It’s important to determine each company’s position within its addressable market and the durability of their growth. These metrics include:

- Glassdoor Ratings: rates three criteria: overall Employee Satisfaction, CEO Approval and Recommend to a Friend. The table ranks CEO approval. Zoom (ZM), which was the highest-rated company in 2020 has seen its Glassdoor ratings deteriorate as its Covid-related growth stalled. (Best rated: Monday.com, ServiceNow (NOW)

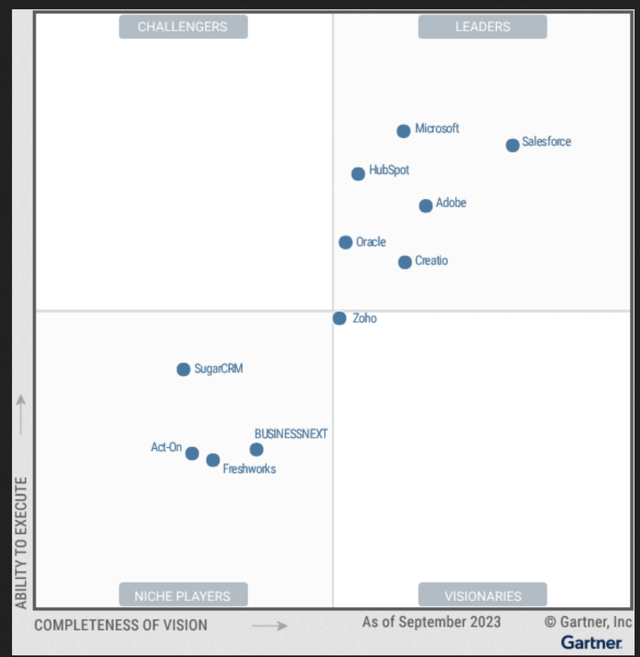

- Business Position: can be measured using the Forrester Wave or the Gartner Magic Quadrant (chart below is for CRM software). Every company included in the table is ranked highly (Leaders/Visionaries) in the Magic Quadrant. Note that leading companies in this table tend to be in multiple businesses, reflecting their broadening TAMs.

- Net Promotor Score (NPS) is a metric based on existing customers’ likelihood to recommend a product or service. However, not all SaaS companies have NPS scores and I’m not certain how reliable they are. Hence NPS was not included in the table for the time-being.

Table Ranking Discussion:

According to studies on successful SaaS companies, there is a certain scale a SaaS company must achieve in order to become successful. Hence in the table below, I’ve screened for companies with an Enterprise Value greater than $10Bn.

The table ranks 7 criteria (equally weighted) for those broad categories of metrics mentioned above. The best companies have the lowest values under the “Overall Score” column. But again, all 10 are best-in-class. For the most part, these companies ranked in the top half for all criteria. I tend to focus on those companies that rank highly for Rule of 40, Net Dollar Retention and Glassdoor. Most of these companies rank above the Regression line. If you recall, that line is created when all of the SaaS companies’ EV/forward Revenues (Y-axis) are plotted against their Revenue Growth Rate (X-axis).

It’s not all “Sunshine & Roses”

Of course, not all is positive. These business models are global and take many more years to develop compared to traditional companies, they also require significant funding in order to deal with the “ Cold Start Problem” and are subject to the “Feast & Famine” of the venture-capital (and liquidity) cycle. Hence, many companies are generating GAAP net losses.

The SaaS model’s consistent and predictable revenue stream offers, well, consistent & predictable stock prices, in theory. However, in practice, SaaS share prices have been particularly volatile. Even mega-cap Salesforce (CRM) witnessed a 19.4% stock decline after publishing 1Q’25 earnings.

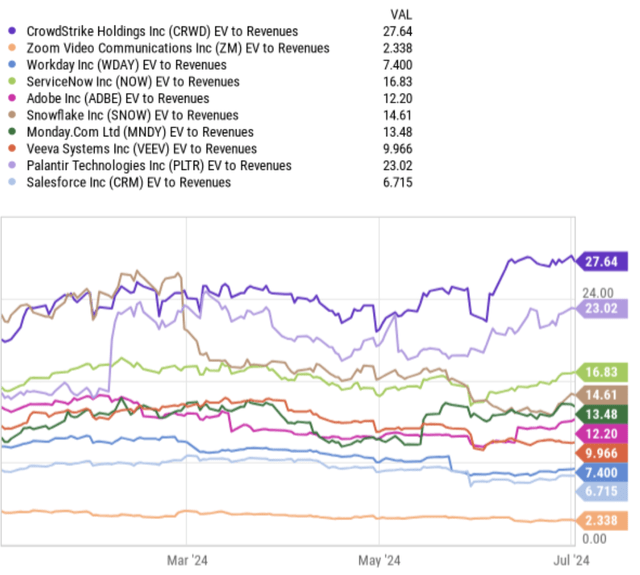

Valuations

There are great companies with bad stocks and vice versa. CrowdStrike (a great company) trades at the highest revenue multiple in the industry – a bad stock ? Zoom Video trades at the lowest valuation (2.3x revenues) and has over $7Bn in net cash and a whopping 38% FCF margin. But for now, some say its shares are “dead-money.”

Portfolio diversification with SaaS

As a former Risk Manager, I am very attuned to portfolio risk & diversification. Until recently, one could simply buy the S&P 500 INDEX (via an ETF) and call it a day. However, today’s S&P 500 is significantly weighted to the Magnificent 7, hence I would recommend diversifying into value funds and a handful of those names above. I’m not fond of SaaS/Cloud Computing ETFs (First Trust, Global X, WisdomTree…) as they have unrelated names or few of my top 10 in their top holdings.

Remember, the list above is the beginning of a research effort – not the end all. Perhaps dollar-cost-averaging into individual names that have had a “bad quarter” could be fruitful. I am constructive on all names with the exception of Palantir which is extremely overvalued and its CEO is admired by only 63% of employees. That’s the worst percentage I’ve ever seen in a SaaS company and makes one wonder…

Note: If you would like me to conduct a “Deep-Dive” on any of these names, let me know in the comments.